[ad_1]

Key takeaways

While property price falls have been capturing widespread media attention, it is crucial for buyers, sellers, and owners to contextualize these figures.

While these declines are noteworthy it is worth noting that the decline in property prices follows a remarkably robust year for the market in 2021, implying that current home values remain significantly higher than their pre-pandemic levels.

It is important to bear in mind that property price declines are not uncommon, and the current downturn is one of the six notable national downturns that have occurred since 1990.

But the pace of falls has started to moderate more recently.

While property price falls have been capturing widespread media attention, it is crucial for buyers, sellers, and owners to contextualize these figures.

So let’s start by looking at what has actually happened to property prices.

Of course the decrease in borrowing capacities caused by increasing interest rates has impacted home values, leading to a consistent decline in national home prices since March 2022.

But the rate of property price falls seems to be decreasing.

According the PropTrack Home Price Index, there was a further 0.1% decrease in home prices in January.

According to Angus Moore, PropTrack’s economist, “Nationally, prices have fallen 4.5% since their peak.”

He further said:

“Sydney has led those price falls, with prices starting to fall a little sooner, and by more.

Prices in Sydney are now down 7.5% since their peak in February 2022.

Melbourne is not far behind, with prices down 6.4% since the peak.

Prices are holding up a bit better in other cities, particularly Adelaide, where prices are down just 0.2% since they started falling in November.”

When it comes to property prices, historical context matters

While these declines are noteworthy and represent a significant shift from the market conditions observed in 2021, it is important to consider the historical context of property prices.

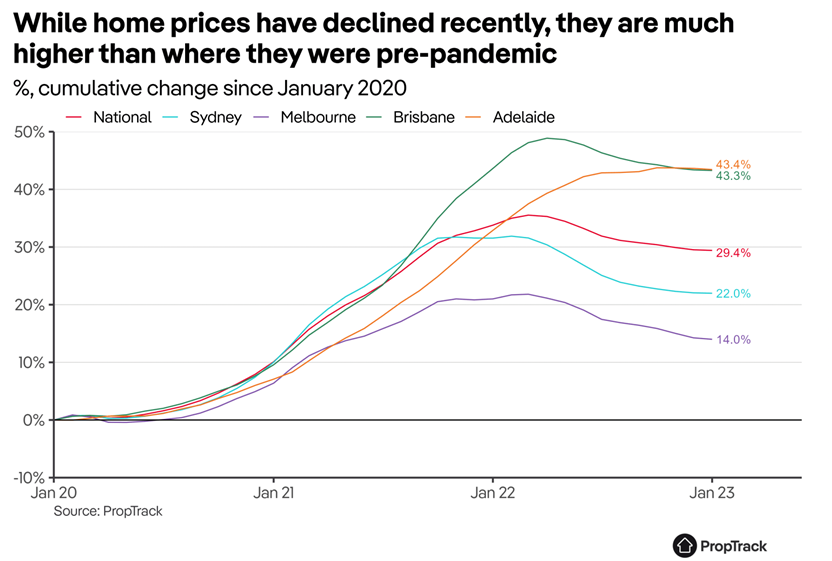

To begin with, it is worth noting that the decline in property prices follows a remarkably robust year for the market in 2021, implying that current home values remain significantly higher than their pre-pandemic levels.

The year 2021 was exceptionally unusual in terms of property price growth. In fact, the national price growth rate of 23% was the third-highest recorded in 140 years.

Despite the recent decline, the strong price growth in 2021 has resulted in an overall increase of nearly 30% in national property prices compared to three years ago.

In popular cities such as Brisbane and Adelaide, which were in high demand during the pandemic, property prices have risen by over 43% in comparison to three years ago.

Even in Melbourne, which experienced a less robust growth rate in 2021, prices have gone up by 14%.

Mr Moore explained:

“While anyone that bought near the peak in 2022 has probably seen their home value fall relative to when they bought, most homeowners aren’t in that boat.

That’s because the vast majority of Australians bought before that peak.

The reality is there just aren’t that many households that buy a home in any given year.

To put that in some context, between January and March 2022 – the point where prices peaked – only around 140,000 homes changed hands across Australia.

That represents just 1.3% of Australia’s more than 10.7 million homes.

Even during October to December 2021 – a very busy period in the market, and a point at which prices were also higher than today – only around 1.6% of homes changed hands.”

Price downturns are not that uncommon

It is important to bear in mind that property price declines are not uncommon, and the current downturn is one of the six notable national downturns that have occurred since 1990.

Moreover, the current downturn was initially very steep, with prices falling by as much as 1% in a month.

Those sharp falls coincided with an abrupt change in outlook from the RBA, which resulted in it successively raising rates by 0.5 percentage points.

But the pace of falls has started to moderate more recently.

Overall, the current property price downturn is comparatively shorter and less severe than the downturns that occurred in 2008-09 and 2018-19.

Nonetheless, it is expected that the decline in prices will persist throughout the year.

Nationally, a further 7% to 10% decrease in property prices is anticipated by the end of 2023.

Consequently, some households, particularly those who made purchases near the peak of the market, may see their property values drop below their purchase price.

However, this outcome will depend heavily on the pace and degree to which the RBA raises interest rates in its efforts to curb inflation.

The general expectation is that the RBA will execute a couple more rate hikes, suggesting that the cash rate’s peak is on the horizon.

[ad_2]