[ad_1]

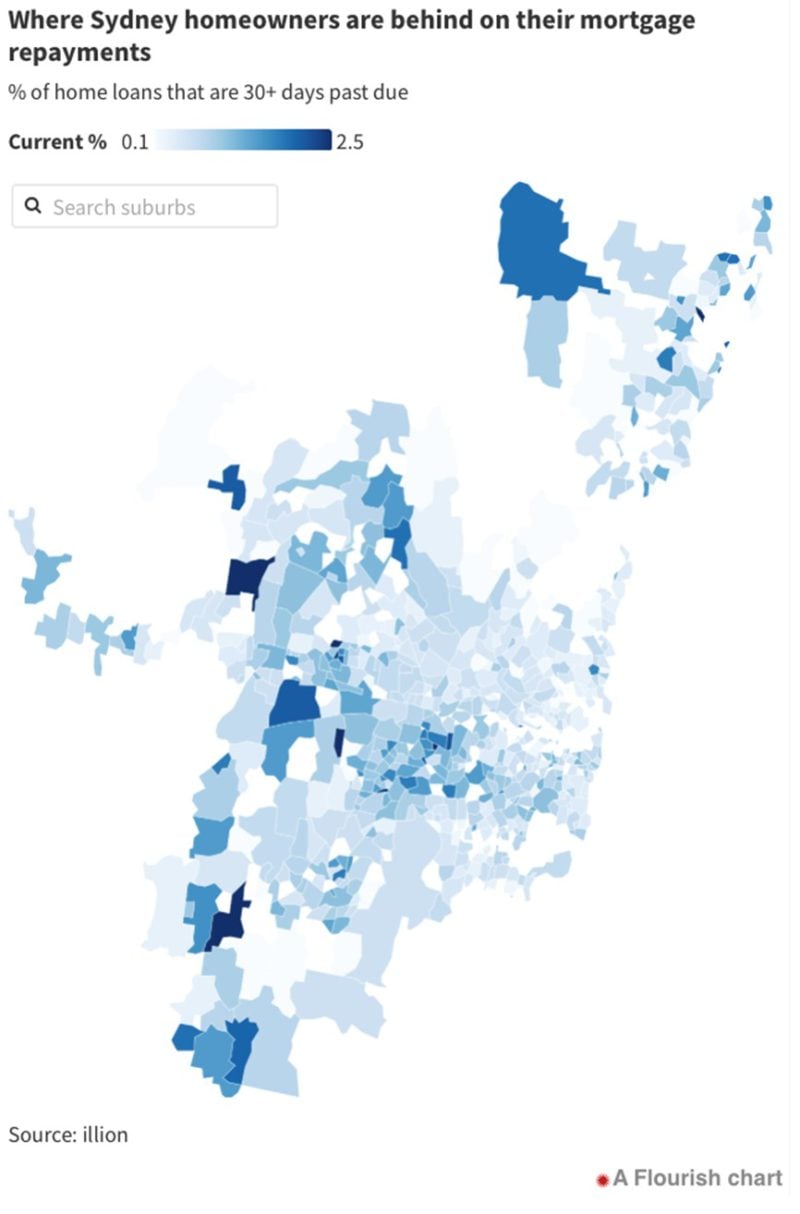

Homeowners in Sydney’s western suburbs are the most financially stressed across the city with as many as 500 households at risk of falling behind on their mortgage, credit bureau Illion predicts.

The data shows that around 0.63% of home loans were more than 30 days overdue in December, which is expected to rise to 0.66% following this month’s 25 basis point interest rate rise.

Another interest rate rise could see that percentage rise to 0.69%, Illion forecasts.

Sydney’s western and southwestern suburbs appear to be most at risk.

Mount Vernon, Old Guildford, and Shalvey in Sydney’s west each have around 2.5% of homes with loans 30 days or more past their due date.

South Granville, also in Sydney’s west, has 2.20% of households with home loans 30 days or more past their due date, which is expected to reach as high as 2.40% with another rate hike.

In the south-west, 2.5% of homes in Mount Hunter are at risk of default after being behind on home loan repayments and nearby suburbs The Oaks, Pheasants Nest, Bargo, Buxton, and Werombi have late payment rates ranging from 1.6-2.5%.

Further north in the Central Coast region, it’s a similar story.

Kulnura, on the west of the Central Coast, has a late repayment rate of 1.9%, which is expected to rise to 2% with another rate hike.

The Entrance and Tacoma have 2.2% and 2.5% of households behind on their mortgage respectively, with another increase expected should we see another interest rate hike.

San Remo and Blue Haven have around 1.9% of households that have fallen behind on their mortgage.

Why these suburbs are falling behind

Ahead of the Reserve Bank’s interest rate hike announcement earlier this month, Illion head of modelling Barrett Hasseldine said the number of households falling behind on mortgage repayments has been on the rise for four months.

This is mainly driven by the rapidly rising cost of living at a time when wages are failing to keep up and households have chipped away or spent their Covid-19 savings buffers.

Households in mid- to low-socioeconomic areas, particularly those who recently bought a home or refinanced during the pandemic, are most at risk as these households have the highest amount of debt with minimal equity.

These households are also already over the threshold they would have been stress tested for up to 3% when they took out their mortgage or refinanced, meaning current rates exceed what they can afford to repay.

In contrast, many of Sydney’s inner or coastal suburbs are owned by people who are long-term mortgage owners who have either paid off a significant part of their mortgage or paid it off in its entirety.

Moving forward markets will be fragmented

Moving forward our property market will be much more fragmented than during the recent property boom.

After all, there was never just one Sydney property market but markets within these markets – there are houses, apartments, townhouses, and villa units located in the outer suburbs, middle ring suburbs, inner suburbs, and the CBD.

And they’re all behaving differently.

Why?

Because, as I mentioned above, each different socio-economic and demographic segment across the city is experiencing the rising cost of living differently.

Inflation, higher rent, and higher mortgage costs at a time when wages aren’t rising at the same rate will either prevent first-home buyers from entering the market or restrict their borrowing capacity.

There are many first-home buyers who borrowed to their full capacity and will struggle to make repayments at increasing rates going forward which will restrict capital growth at the lower end of the property market.

Then there are the gentrifying suburbs where more affluent homeowners have established money with higher disposable incomes and who are at minimal or even no risk of defaulting on mortgage repayments even in the face of rising rates.

Only invest in these areas

The fragmented property market across Sydney means I would only ever recommend investing in the areas where residents’ income is increasing faster than the national average.

These would be the gentrifying suburbs with established money.

That’s because it’s these suburbs which are able to withstand fluctuations in the property market and increases in interest rate rises.

These locations typically have higher disposable incomes and people are likely to be prepared to pay a premium to live in a property in one of these locations.

Houses and townhouses in these areas would typically make great investment opportunities.

Most importantly, you need to ensure you invest in an investment-grade property… because while any property can be considered an investment, they don’t all make good financial sense.

What makes a great investment property for me, is not likely to be the same as what would suit your investment needs.

You also need to make sure to invest only in areas where properties hold their value over the long term.

But even before looking for the right location, make sure you have a Strategic Property Plan to steer you through the upcoming challenging times our property markets will encounter.

Because aside from remembering that you should focus your efforts on investment-grade properties and locations, you also need to remember that property investing is a process, not an event.

That means that things have to be done in the right order – and selecting the location and the right property in that location comes right at the end of the process.

[ad_2]