[ad_1]

As someone who is planning to buy a new car by 2025, I’m having second thoughts. With the average new car price at almost $50,000, it seems like only the rich can buy new cars today!

Think about it. If you follow my 1/10th rule for car buying, you need to earn $500,000 to buy the average new car. However, a $500,000 household income is the start of a top 1% income!

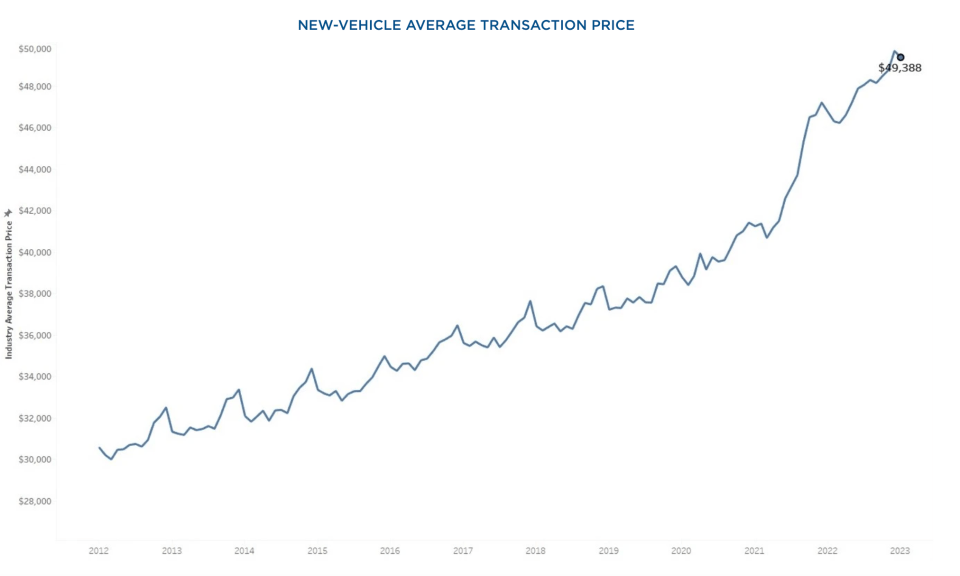

Below is the new vehicle average transaction price chart by Kelly Blue Book through January 2023. As you can see, the average transaction price is $49,388, up 5.9%, or $2,768 from a year ago.

In contrast, the average price of a used car is about $27,000. A $22,388 spread between the average new car price and average used car price is significant.

Owning A New Car Is An Indicator Of Wealth

Based on the average new car price in 2023, owning a new car is one indicator of wealth. If you want more status, then own an average new car! People might treat you with more respect.

However, if you believe in Stealth Wealth, then owning the average new car is never going to happen. You don’t want to attract unwanted attention in the land of envy and thieves. As a result, you rationally drive an older car that is less expensive.

Of course, you could also buy a cheaper-than-average new car, like a Honda Civic for $25,000 and not be considered wealthy. It all depends on your age when the new car is purchased.

If you’re buying a new Honda Civic for $25,000 at age 25, you’re considered rich. But if you’re buying a new Honda Civic at age 60, you’re considered relatively frugal. After all, the median income increases with age.

New Cars Everywhere Is A Bullish Indicator

Unfortunately, I drive between 40 – 100 minutes a day due to school and sports activities. I dislike driving, but there are no efficient transportation alternatives.

I always notice new cars everywhere when I’m driving. And each time I see one, I multiply the estimated car price by 10 to arrive at the driver’s potential household income. I’m in awe of how there are so many high-income households.

Rush hour traffic is also bad in San Francisco. Even with the work-from-home movement gaining popularity in the Bay Area, traffic is still terrible.

But one day, I changed my mindset.

Instead of getting annoyed at the tremendous amount of city traffic, I started to get inspired. Heavy traffic means business is booming! And when business is good, that means I should be able to earn more passive investment income to stay free.

Go traffic jams and drivers who double park on busy streets!

The media loves to focus on doom and gloom because negative stories get more attention. However, if you sit in traffic every day as I do, you’ll quickly realize the economy is doing just fine.

The average new car price of almost $50,000 isn’t sustainable if there isn’t demand. And demand isn’t sustainable if household incomes are not concurrently rising.

Maybe Fools Are Also Buying New Cars

Yes, the rich are likely the main people buying new cars. But maybe fools are buying new cars as well.

After all, the average monthly payment for a new car has risen to a record $777, nearly doubling from late 2019, according to Kelley Blue Book. Even used models have climbed to $544 a month in car payments on average.

However, call me naive, but I don’t think a rational American looking to achieve financial freedom would ever spend so much money on a new car. To think the average American is irrational is to also think the average American is a fool. And we ain’t no fools!

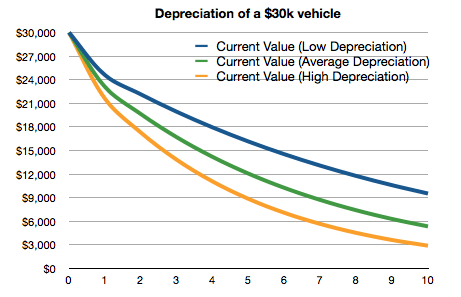

We all know new cars have the steepest depreciation curve after the first three years. Further, we all know saving and investing aggressively are musts to achieve financial freedom.

Given 70% of Americans are disengaged at work, it also means 70% of Americans don’t want to be slaves to their jobs forever. If you hate your job, it makes no sense to use a large chunk of your savings or take on a $777 monthly payment to buy a new car.

New Cars Priced Around $50,000

Given only the rich can buy the average new car, here is a list of new cars priced around $50,000. This way, we can quickly identify who is rich and who is not!

- Lexus ES

- Audi A4, A5, S3, A6

- Volvo V60, XC60, S60

- Volvo XC60

- Volkswagen Arteon

- BMW 2, 3, 4 Series, I-4

- Acura TLX

- Tesla Model 3, Model Y

- Hyundai Genesis G80, GV80

- Mercedes Benz C-Class

- Kia Stinger

- Cadillac CT5-V

- Nissan Z

With taxes and fees, some of these cars are pushing $60,000. Here in San Francisco, many of these new car models are a dime a dozen, especially the Tesla Model 3 cars.

Even my softball acquaintance drives a Model 3. Even though he doesn’t make $500,000+ as an educator, he did amass an almost $1 million position in Tesla stock on margin. Hence, people buying the average new car have financial resources other than their incomes.

Thoughts About Buying A New Car For My Family

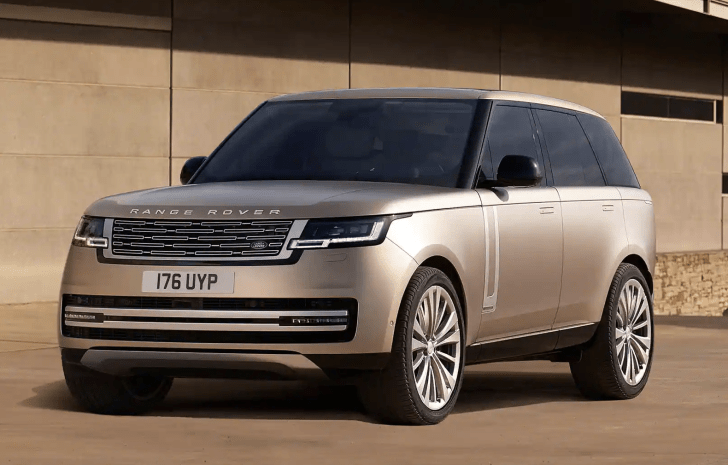

The reason why I’m looking to buy a new car in 2025 is because my Range Rover Sport will be 10 years old by then. Mainly due to safety, I think the ideal length of time to own a car is when the car hits 10 years old.

Safety features are always improving every year. Car engineers aren’t just twiddling their thumbs each year collecting a paycheck. Given I have to transport children, I’m not willing to drive a car much older than 10 years old.

I’ve driven much older cars before. And just like with owning rental properties, something always comes up.

Here are some of my old car failure examples:

- Timing belt on my 15-year-old Toyota Corolla snapped one day.

- Brakes stopped working in my 18-year-old 1989 BMW CSI while pulling into a Best Buy parking lot

- Engine in my 12-year-old 1997 BMW M3 started lurching because the transmission was failing

The spare donut tire in your car should be replaced every 10 years given rubber hardens and cracks. Meanwhile, airbags might not work properly after 10-15 years.

If a car malfunction were to cause an accident and injure my passengers I would never forgive myself if I could have afforded a safer car. The best time to own the nicest car you can afford is when you have children.

I’m sure I could drive my car until it is 15 years old to save money given I only drive about 6,000 miles a year. However, it’s probably not worth the risk given I can afford to buy a new car sooner.

Will Probably Still Buy A Slightly Used Car

Owning a new car is nice. Who doesn’t love the new car smell?! But the depreciation on a new car is too dramatic to stomach. Instead, I’ll probably buy a two-or-three-year-old car to save money.

Personally, I like the new design of the latest Land Rover Range Rover. Too bad it costs about $150,000 moderately equipped! If I really want to ride in style, I best start writing more bestselling books.

It really seems like only the rich can afford to buy new cars today. Are you one of them? If you aren’t, how did you afford to buy a new car at today’s astronomical prices?

For more nuanced personal finance content, join 55,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

[ad_2]