[ad_1]

Last week, a prospective client asked me a very good question.

They asked whether I have data that shows what investment returns my clients have generated.

Whilst this sounds like a logical question, my response was that not only did I not have this data, but it also wouldn’t necessarily be that useful.

The reason is that investment returns are highly dependent on a client’s stage of life, their risk profile, the quantum of their investable income, their starting financial position, and so on.

Unless all those factors are identical to this prospective client, the returns are not relevant.

But the question got me thinking; how important are investment returns anyway?

Short term investment returns don’t give you the full story

If I told you that my clients enjoyed a 100% return over the past 12 months, would you be impressed?

Of course, no one’s going to be upset with that return but it tells me nothing about:

-

- The risk that I took to achieve that return.

High returns are almost impossible to achieve without taking a high risk; and - Whether that return is sustainable.

The laws of compounding growth tell us that it’s more powerful to consistently generate a sustainable return (e.g. 8% p.a.) over many decades.

That should be your goal.

- The risk that I took to achieve that return.

Returns become more important over long periods of time

It is very possible that when I start working with a client, in the short run, they might be financially worse off.

I have two examples to demonstrate this.

The first example is when I advise them to invest in property.

In that first year, they pay for a lot of large expenses such as stamp duty and buyers’ agent’s fees.

This diminishes their net asset position.

The second example occurred last year when we had actively reduced exposure to the seemingly overvalued US tech sector prior to Covid.

As we know, the tech sector was the greatest beneficiary of Covid in 2020.

Consequently, our portfolios underperformed over the year to December 2020.

However, based on initial investigations, it appears our portfolios have more than made up for that underperformance over the year ended June 2021 (being underweight tech has served us very well to date in the calendar year 2021).

The lesson these two examples demonstrate is that sometimes short-term returns suffer in the pursuit of maximising long-term returns.

This is acceptable, unavoidable, and necessary.

I can’t control markets or returns

I can’t control investment returns, especially in the short term.

No one can. In the short term, markets can be irrational, unpredictable, and highly volatile.

No one in the world has developed a model to reliably predict short-term returns with any meaningful consistency.

The factors that I can control (on behalf of my clients) include investment fees, the methodology we employ (i.e. whether it’s robust, tested, and evidenced-based), the investment strategy/plan that we formulate, asset allocation, and the quality of the investment.

In the long run, all these factors will be responsible for delivering investment returns.

To use an analogy, a personal trainer doesn’t have any control over the weight her client loses in the short term.

All she can control is how much her client exercises, the meal plan that her client follows, and other environmental factors.

The weight her client loses is merely a consequence of her client’s behaviour.

But if her client follows her advice consistently over many months and years, the results become more predictable.

In fact, the value of advice has little to do with investment returns

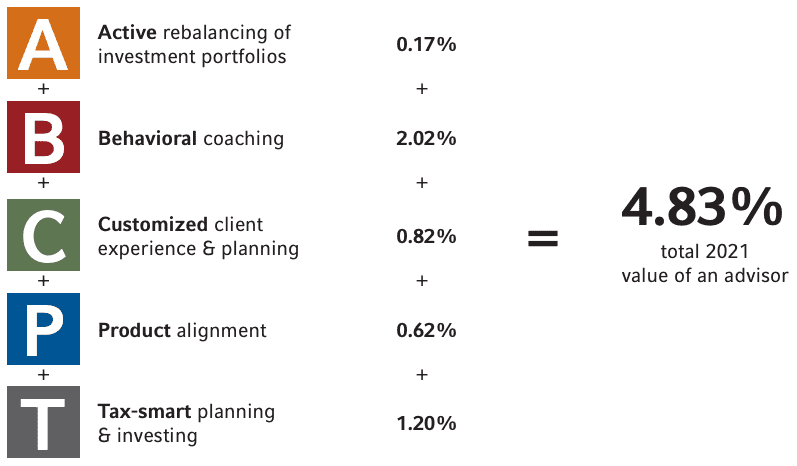

This 2021 study by global fund manager Russell Investments suggests that quality financial advice contributes 4.83% towards your investment returns each year.

That is the value of financial advice.

Interestingly, it is estimated that the investment aspect of what a financial advisor does only contributes a relatively small amount of value.

This includes two aspects:

- Asset allocation (which is referred to as ‘product alignment’ in the report).

This is the decision of where to invest your monies; and - Active rebalancing is the decision of how to change where your money is invested over time.

The report estimates this only contributes 0.79% towards your investment returns (which is less than 16% of the total value of advice).

The majority of value is from…

According to this study, the majority of the value of financial advice is derived from three activities:

- 2.02% comes from behavioural coaching. I describe this as stopping my clients from making costly mistakes.

A ‘mistake’ can include not following fundamentally sound financial advice.

This can be incredibly valuable. - 1.20% comes from saving tax i.e. structuring investments tax-effectively.

This can include using different ownership structures, different investment products, distribution and franking strategies, super strategies, and so on. - 0.82% comes from having a strategic plan.

A strategic plan provides context for making decisions.

That is, you will be able to assess whether doing X or Y contributes towards, or detract from, the success of your plan.

Without this context, you are flying blind.

Whilst this report sets out how the authors have calculated these value estimates, we must remind ourselves that it’s a generalisation, and the actual value will be different for everyone.

Also, the report was prepared by an investment manager to help its clients (who are financial advisors) articulate their value.

But, putting aside this lack of independence, I agree with the general premise of the report in that an advisor’s role is to help their clients optimise factors that they can control.

This includes making quality decisions, reducing taxes, sticking to a long-term strategic plan, and so on.

My goal is to help you achieve yours

Choosing an advisor can be a difficult task because it can be challenging to assess what value you may receive.

It is hard to assess the value of advice if the advice has not yet been formulated.

Focusing on factors such as independence, experience, creditability, and philosophy goes a long way.

And perhaps the other factor is the longevity of the advisor’s client relationships.

Typically, clients will only remain with an advisor if they:

- Feel like they get more value than they pay and

- They are happily advancing towards their goals.

Therefore, if the advisor doesn’t lose many/any clients, that’s strong evidence that their clients are satisfied.

ALSO READ: The Power of Gentrification. How to use the cycle of the suburb to boost your investment returns

[ad_2]